|

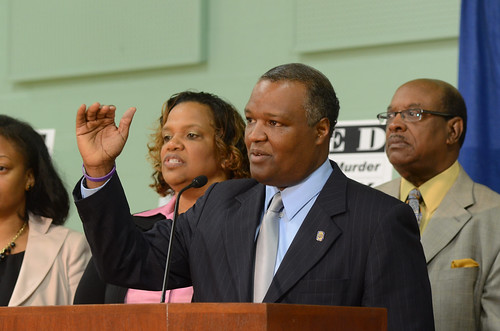

| CEO Dr. Kevin Maxwell. Image from PGCPS. |

This past December—before Prince George’s County Executive Rushern Baker hatched his

hare-brained idea to raise the county’s already-too-high local taxes through the roof—the public schools CEO, Dr. Kevin Maxwell, requested a

$1.84 billion budget for FY2016.

Everyone agreed that Dr. Maxwell’s budget would allow the schools to continue making progress, as they had been doing over the previous year under his leadership. This is the budget that, with some modifications, the County Council should adopt this week.

Much of the debate and discussion over the past two months has centered on the

revised $1.93 billion budget that Prince George’s County Public Schools (PGCPS) and the county executive proposed in March. This revised proposal would increase the county’s tax-funded contribution to the school system by $133 million and would require a 15.6% increase in real property tax rates and a 50% increase in cell phone tax rates, among other tax increases. Baker would use a state law loophole to get around the county charter-imposed

property tax cap known as TRIM, which has been in place since 1978.

Even after weeks of town halls and community forums, the public and the county council

remain skeptical about Baker’s tax-hike plan to fund the revised PGCPS budget proposal. A

2014 state audit of PGCPS’s financial practices noted serious concerns with the system’s financial controls, accountability practices, and cost efficiency strategies. Several council members have called for a full and

independent performance audit of PGCPS’s practices, but that won’t happen until at least a year from now.

No one on the council has voiced support for Baker’s schools plan, although some appear

willing to consider a modest property tax increase of about 3%. The county Chamber of Commerce floated a

proposed compromise to cut Baker’s tax increase in half, to about 8%, but the county executive

shot down that plan.

The council is scheduled to adopt the FY2016 budget on Thursday, May 28, and council members are reportedly still trying to craft a final draft. But there’s no need to reinvent the wheel as far as PGCPS is concerned, because the budget that Dr. Maxwell originally proposed in December gets it largely right.

Dr. Maxwell’s Budget Will Allow PGCPS to Continue Making Progress

Since Dr. Maxwell took over as CEO of PGCPS in the 2013-14 school year, enrollment has grown, graduation rates have increased, and promotion rates have improved. When he released his proposed FY2016 budget in December, Dr. Maxwell stated that it “continues the progress we have made, while recognizing that fiscal uncertainties do exist.”

The CEO’s budget proposed a 2.5% increase over the FY2015 budget of $1.8 billion and included a $53.5 million increase in the county tax contribution. $14.3 million of that amount was required by increased enrollment coupled with state law-imposed “Maintenance of Effort” (MOE) requirements, which dictate that school systems cannot backtrack on per-pupil expenditure levels from year to year.

|

| Image from Global Partnership for Education on Flickr |

The remaining $39.2 million of Dr. Maxwell’s proposed budget increase was designed to fund certain priorities in his strategic plan, including expanded pre-kindergarten programs, additional reading specialists, and expansion of high-demand programs like language immersion, International Baccalaureate, and Montessori.

In the December 12, 2014,

news release announcing Dr. Maxwell’s requested budget, Board of Education chair Dr. Segun Eubanks said, “Dr. Maxwell has proposed an ambitious budget to move our system forward.” Similarly, county executive Baker lauded Dr. Maxwell’s proposal as “prudent and pragmatic,” noting that it “appears to fund priorities and invests in programs that will attract families to PGCPS.”

In other words, everyone agreed more than five months ago that Dr. Maxwell’s originally proposed FY2016 budget was sound and that it would move PGCPS forward.

Dr. Maxwell’s Budget Comports With the County Charter and TRIM

Being a longtime Prince George’s resident and having worked in the PGCPS system previously, Dr. Maxwell was fully cognizant of the property tax caps imposed by TRIM. He was also aware that the county charter required any increase in property taxes to be approved by the voters in a referendum. Thus, Dr. Maxwell crafted a budget with those principles in mind.

In 2012, the Maryland legislature passed a state law (

SB 848) that allows counties to exceed charter-imposed property tax caps to fund education programs. However, this law was designed to ensure that counties could meet their MOE requirements (as discussed above) in the unusual circumstance where their property tax caps would not otherwise allow them to do so.

Prince George’s MOE requirement for FY2016 would only necessitate an increase of $14.3 million in the PGCPS budget, which the county could easily do without raising tax rates. County executive Baker’s proposal, by contrast, seeks to use SB 848 to effect a

discretionary budget increase of

more than nine times that required by MOE. This smacks of political gamesmanship and abuse, and only exacerbates the

well-earned trust deficit that county officials have sown with their citizens through years of corrupt practices.

If the county executive wants to overturn TRIM and the charter requirement for referendum approval of taxing increases, he should make his case with the citizens and propose the appropriate charter amendments to be voted on in an election. What he shouldn’t do is misuse a well-intentioned piece of emergency state legislation to do an end-run around the people who put him in office.

The Council Should Fund Some Additional Student-Supportive Items

Dr. Maxwell’s initial budget request included a $39 million reserve for “negotiated compensation improvements,” presumably for teachers. However, it did not include approximately $9 million in additional funding for several later-proposed items relating to the “Safe and Supportive Environments” and “Family and Community Engagement” prongs of his strategic plan. Dr. Maxwell’s budget also did not include the approximately $2 million in additional funding that would be needed to fully fund the pre-kindergarten expansion. Instead of fully funding the $39 million teacher compensation reserve, the County Council should modify Dr. Maxwell’s budget request to include the $11 million for those missing items.

|

| Image by naught_facility on Flickr. |

Dr. Maxwell has made a compelling case over the past couple of months for the need to establish a second shift for maintenance workers and purchase additional supplies, to allow the school system to address several deferred maintenance issues more quickly. He’s also made impassioned and convincing arguments for including additional funding for a universal free breakfast program, parent advocates, and translation services, among other items. And the importance of pre-kindergarten programs can hardly be doubted.

In contrast, Dr. Maxwell’s arguments for enhanced teacher compensation fall quite flat and, in some respects, are plainly disingenuous. The average teacher compensation in PGCPS is already the fourth- or fifth-highest in Maryland, behind Montgomery, Calvert, and Howard counties, and sometimes Baltimore City. PGCPS also far exceeds the average compensation rates in Virginia and nationally.

Contrary to Dr. Maxwell’s stump-speech arguments during the recent town hall forums, PGCPS is not losing a high number of teachers to higher-paying school districts like Montgomery County. In fact, of the 2,871 teachers who left PGCPS between 2010-2013 (the most recent three years for which attrition statistics are available), only 75 (or 2.6%) left for higher-paying school districts in Maryland, and only 48 of those (or 1.7%) went to Montgomery County. (PGCPS officials refused repeated requests to provide data on the number of teachers, if any, who left for higher-paying jobs in DC or Virginia.)

The remaining $28 million that Dr. Maxwell proposed for reserve teacher compensation improvements should be used to offset the $20 million reduction in state funding to PGCPS resulting from

Governor Larry Hogan’s refusal to fully fund the Geographic Cost of Education Index (GCEI) formula and/or to reduce or eliminate the need for furloughs in other part of county government.

Bottom line: there is no need to raise local taxes to ensure adequate funding for the Prince George’s County Public Schools. The county council should instead fund the FY2016 budget that Dr. Maxwell originally requested this past December, with slight modifications to ensure adequate funding for safe and supportive schools and family and community engagement.

UPDATE (05/26/2014 11:00 pm): Several people have contacted me offline and asked for a clearer breakdown of the modifications to Dr. Maxwell's budget that I'm suggesting in this blog. I've posted a marked-up document HERE that provides those figures.